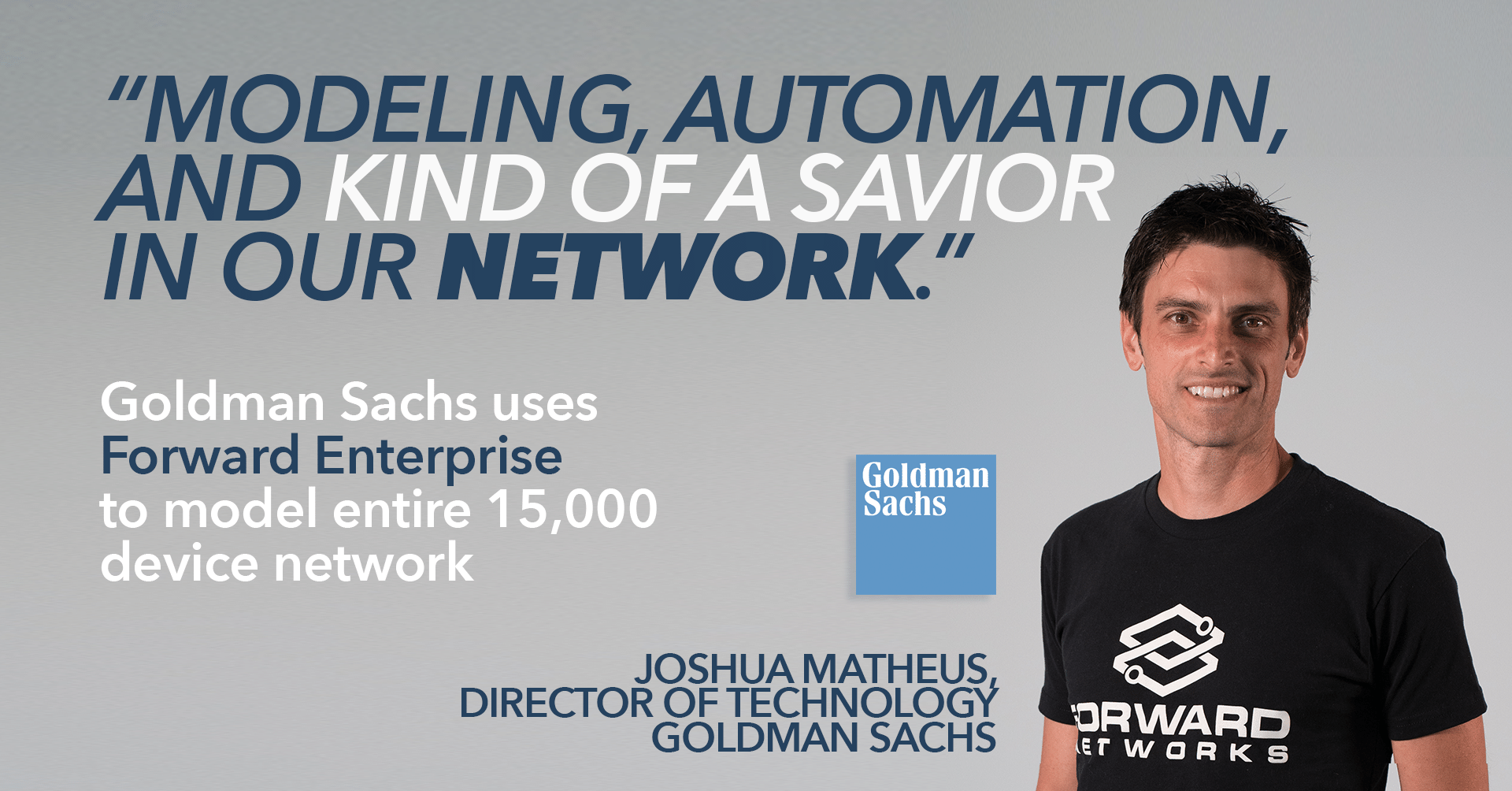

Case Study: Goldman Sachs uses Forward Enterprise to model entire 15,000+ device network

Goldman Sachs | INDUSTRY: Financial Services | SIZE: 57,000+ | LOCATION: New York, NY

Headquartered in New York, NY, Goldman Sachs is a leading global banking, securities, and investment management firm. Their complex multi-vendor network, comprised of over 15,000 switches, routers, and firewalls, processes millions in assets every day in every major banking center in the world. Because their network is mission-critical, Goldman Sachs acts in accordance with strict security compliance requirements and manages network reporting to both Securities and Exchange Commission as well as internal application teams. For more information, visit goldmansachs.com.

|

CHALLENGES |

SOLUTIONS |

RESULTS |

|

• Replacing an internally built path tool that only provided partial coverage and was difficult to maintain • Needing a visual method of diagramming the network as well as the ability to export it for reporting purposes • Verifying network connectivity for specific applications to ensure performance and availability

|

• Forward Enterprise Search function • Forward Enterprise Topology function • Forward Enterprise Verify function

|

• Enabled interactive and automated path searches. Teams can identify whether traffic will traverse the network successfully and gain details on any dropped traffic • Provided full visibility of the network in an exportable and user-friendly graphic interface • Presented and confirmed application functionality and change assurance

|

World-class financial institutions such as Goldman Sachs are always evolving. They and other modern multinational banks are focused on innovation and digital transformation to ensure that the billions of transactions every day are secure and predictable. Digitization and the adoption of emerging technologies allow banks to operate more efficiently but also bring new and unique challenges to their network architects and operators. Beyond the challenges that come with

implementing new technology, government regulations dictate strict policy compliance. Oversight agencies perform routine and outage related checks that raise the requirements and manpower needed to manage their network.

Goldman Sachs employs highly sophisticated technologists to stay on the cutting edge of digital transformation. With the goal of reducing the occurrence of high severity incidents, they worked

for years internally developing tools to effectively map, verify, and automate their network operations. Ultimately, maintaining and scaling some of these tools was better left to outside expertise. While the network team was skeptical at first, Forward Enterprise seemed to solve the challenges they were facing: comprehensive path search, visualization/diagramming, and network readiness for application rollouts. After a proof of concept period, the Forward platform not only proved to be fully scalable to all 15K+ network devices, but the Forward product and engineering experts showed the ability to quickly move feature requests into product updates.

Today the network team at Goldman Sachs relies daily on Forward Enterprise to perform end-to-end path analysis, proactively ensuring that network behavior is aligned with stated policies and intent. They have significantly improved operational efficiency, and successfully reduced change related incidents.

“In the past year, we have scaled our deployment of Forward Enterprise to our entire network of over 15,000 devices. Our network engineering team relies on the Forward platform to be the single source of truth for our network. It’s a critical component for automating our infrastructure.”

- Joshua Matheus, Managing Director, Technology, Goldman Sachs

FOR MORE INFORMATION:

Related Articles

Join The GBI Impact Community

Sign up to make an impact and hear about our upcoming events

By registering anywhere on the site, you agree with our terms and privacy policy