Empowering The World’s Leading Financial Services Organizations to Accelerate Innovation and See Around Corners

Financial services organizations have long recognized that maintaining a complete, accurate, and current view of their distributed enterprise data can transform the way they collaborate, compete, serve clients,

and make decisions. Becoming a data-led organization, however, is often far more complicated than business leaders expect, and delivering the right data to support critical business needs is becoming increasingly challenging.

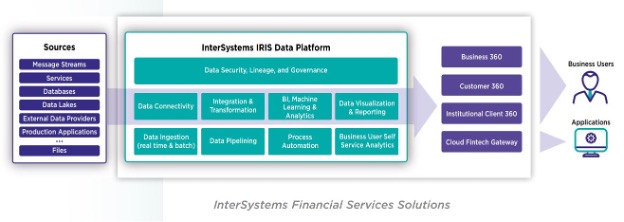

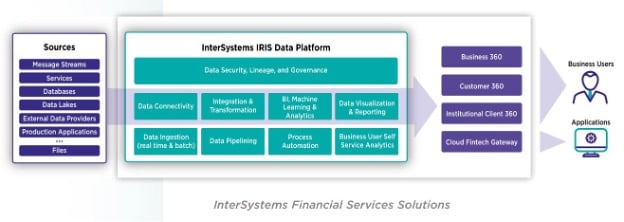

InterSystems® makes the shift to a digital, data-driven approach possible by enabling business leaders and their teams to take full advantage of a 360-degree view of data from inside and outside the organization, delivering a wide range of benefits, including improved decision support, outstanding customer experiences, better compliance, stronger risk management, increased revenue generation, enhanced operational resilience, and accelerated innovation.

InterSystems provides a powerful set of solutions and capabilities that are enabling financial services firms of all sizes to better service their employees, partners, and customers.

Business 360 for Financial Services

InterSystems Business 360 provides financial services firms with a better, faster, and easier way to unlock information from disparate data silos, drive collaboration, and provide line-of-business managers with access to better insights from across the organization to meet their myriad business goals.

Customer 360 for Financial Services

InterSystems Customer 360 makes it faster and easier for financial services firms to create and maintain a complete 360-degree view of every customer, delivering a wide range of benefits, including improved customer experience, hyper-personalization, increased revenue, reduced churn, and higher operational efficiencies.

Institutional Client 360 for Financial Services

InterSystems Institutional Client 360 enables financial services firms to deepen their institutional relationships and grow revenue by providing access to all institutional client activity and information from both inside and outside the organization. Armed with these insights, firms can proactively anticipate clients’ needs, quickly respond to emerging opportunities and issues, and provide a set of differentiated, high-value, hyper-personalized experiences.

Cloud Fintech Gateway

The rate of innovation within the financial services sector has increased dramatically. As traditional financial services organizations work to keep pace, they often incorporate technology from fintech providers to quickly implement new cloud-based applications and services. Empowering financial services organizations to achieve their goals requires that these cloud-native solutions can be swiftly and easily integrated into their existing technology infrastructure. InterSystems Cloud Fintech Gateway is enabling financial services firms to integrate these cloud-based fintech applications and services faster and more efficiently by providing seamless, bidirectional real-time integration with their existing production applications and data sources.

Key Benefits

Informed Decisioning Leveraging Live Data

- Incorporate real-time transactional data and eliminate delays in accessing data stored in production applications and data silos, enabling business leaders to make decisions based on accurate and current data, not data that is weeks old, eliminating errors and missed business opportunities

Business User Self-Service

- Compared with just static dashboards, dynamic self-service data exploration capabilities enable business users to explore the data, ask ad hoc questions, and drill down via interactive queries in an iterative manner, reducing the reliance on IT for answers to their questions

More Diverse Data, for Better Insights

- Incorporates more data from more sources, providing a more complete and comprehensive view of the business and more insightful analytics

Increases Operational Efficiencies

- Enables advanced analytics, including machine learning, business intelligence, natural language processing, business rules, and predictive models to be incorporated into real-time processes flows, dashboards, and reporting, streamlining operations and increasing efficiencies.

InterSystems IRIS Data Platform

InterSystems IRIS® is the next-generation data management software powering InterSystems suite of financial services solutions for a wide range of financial services customers, leveraging a modern smart data fabric approach that addresses the limitations and delays associated with previous approaches.

InterSystems technology is used in production applications by most of the top global banks, as well as by asset management, retail and commercial banking, hedge funds, insurance, and other large and midtier financial services organizations around the world.

For more information, visit InterSystems.com/financial or contact us at info@InterSystems.com.

Related Articles

Join The GBI Impact Community

Sign up to make an impact and hear about our upcoming events

By registering anywhere on the site, you agree with our terms and privacy policy